About Bitcoin

Bitcoin is the world’s first digital money — secure, scarce, and independent from governments and banks. Created in 2009, it was designed to solve one of the biggest problems of traditional money: inflation and control by central authorities.

With only 21 million coins ever created, Bitcoin is often called digital gold. Unlike dollars or shares, no one can print more, shut down the network, or change the rules.

For Australians looking ahead to retirement, that makes Bitcoin a unique long-term asset to hold in a Self-Managed Super Fund (SMSF).

Why Bitcoin Matters for Retirement Investors

Traditional super funds keep you limited to stocks, bonds, and managed funds. But these all share a weakness: they rely on governments, central banks, and fund managers.

Bitcoin offers something different:

Scarcity: A hard cap of 21 million coins, ever.

Independence: No central bank or government controls it.

Global reach: Accessible anywhere, 24/7.

Resilience: 15 years of proven uptime and adoption.

Diversification: A store of value outside the AUD and property market.

💡 Did you know? Since 2009, Bitcoin has been the best-performing asset in the world.

Key Properties of Bitcoin

Decentralised: No central authority; run by a global network.

Limited supply: 21 million coins, never more.

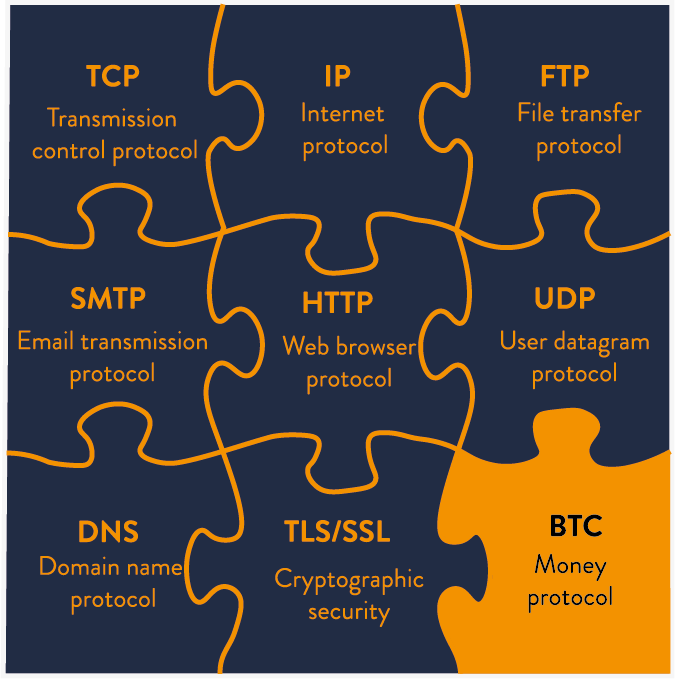

Secure: Protected by advanced cryptography and the blockchain.

Transparent: All transactions are recorded on a public ledger.

Borderless: Send and receive globally without intermediaries.

Portable: Take your wealth with you anywhere in the world.

Volatile: Prices can swing — long-term perspective is essential.

Risks to keep in mind

Like any investment, Bitcoin has risks:

Volatility: The price can move quickly up or down.

Regulation: Rules around Bitcoin and SMSFs continue to evolve.

Security: Safe storage is critical to avoid loss.

This is why the right structure and custody model matters. At BitcoinSuper.io, we show you how to set up your SMSF and hold Bitcoin with proper security and compliance — without the risks of exchanges or complex self-custody.

Why Bitcoin Fits in an SMSF

A Self-Managed Super Fund gives you control and choice. Adding Bitcoin can:

Diversify beyond shares and property.

Protect against inflation and currency debasement.

Position your retirement savings for long-term growth.

With professional support, your SMSF can hold Bitcoin safely, securely, and compliantly — so your stack is protected for the long run.